Portfolio Investments

Value Edge team will provide efficient, cost-effective and transparent service to manage your assets and your wealth under absolute privacy. Our strict code of ethics combined with our potent analytic process offers a distinctive investment management service. Our clients benefits from proprietary and cutting-edge technology providing outstanding ROI with absolute transparency.

Softlanding in Mexico

The legal structure of any startup is the foundation on which an enterprise is built, so choosing a structure that best suits the new business is essential to its success. The Business Startup Practice at Value Edge offers a wealth of experience to domestic and international clients with interests in Mexico and abroad.Through strategic alliances with expert and sounded attorneys in Mexico, New York and London, our Business Startup proffesionals work with entrepreneurs, directors and officers on the following matters:- Articles of Incorporation

- Partnership Agreements

- SAPI, SA, or SC Formation

- Shareholder Agreements

- Asset and Stock Purchase AgreementsFor international clients seeking to establish a business in Mexico, we offer a complete range of U.S. entity formation services. For clients conducting business abroad, our Business Startup Practice works with the Firm’s affiliated international counsel to provide service and advice that is current and informed.

Financial Planning

Literate in Data, Finance and Economics, Value Edge's team will provide fresh, informed and structured view of the context and alternatives for you to choose the optimal decision. Our team is trained to find the highest shareholder value in every context. We do not replace your experts, although we provide a fresh and cutting edge view and structured solution to amplify your net benefits.

Valuation

Value Edge cumulative experience and technical capabilities will provide outstanding service for Valuation. Fluent in Data, Finance and Economics our team would be capable to front-face any Negotiation with the technical strength in your favor. Value Edge may also serve as arbitrator to solve private and judicial disputes, in collaboration with authorities when required

Macroeconomics

Accurate macroeconomic forecasting is essential for business decisions, financial trading and as a basis for policy decisions by politicians, economists and business persons.

Value Edge's experienced economists are available on a consultancy basis to address your specific needs. We produce robust economic analysis, insight and research to help your organization to achieve optimally informed decisions.

Contact us

Tailored and Confidential Financial Guidance

Tamarindos 400-A P21 Bosques, CDMX, 05120 | +52 55 9816-0270

2333 Brickell Ave St 1D, Miami, FL, 33129 | +1 (305) 289-8210

Investment Process

Setting your goals: We help in establishing our goals to provide structure and purpose for your investments. Goals can help you meet major life objectives, such as retirement or face child's higher education.

Determining risk tolerance: We asssit in measure of how much risk you are willing to take on, in exchange for potential higher returns.

Asset allocation and Diversification: With the above, we assist in how to choose from different investments and allocate a portion of the budget into each. This involves investing in a variety of assets, such as stocks, bonds, and cash with several objectives including mitigating risk.

Monitoring and adjusting:

This involves tracking your portfolio's progress, key metrics, and milestones to sugest and make adjustments as needed.

Asset Allocation

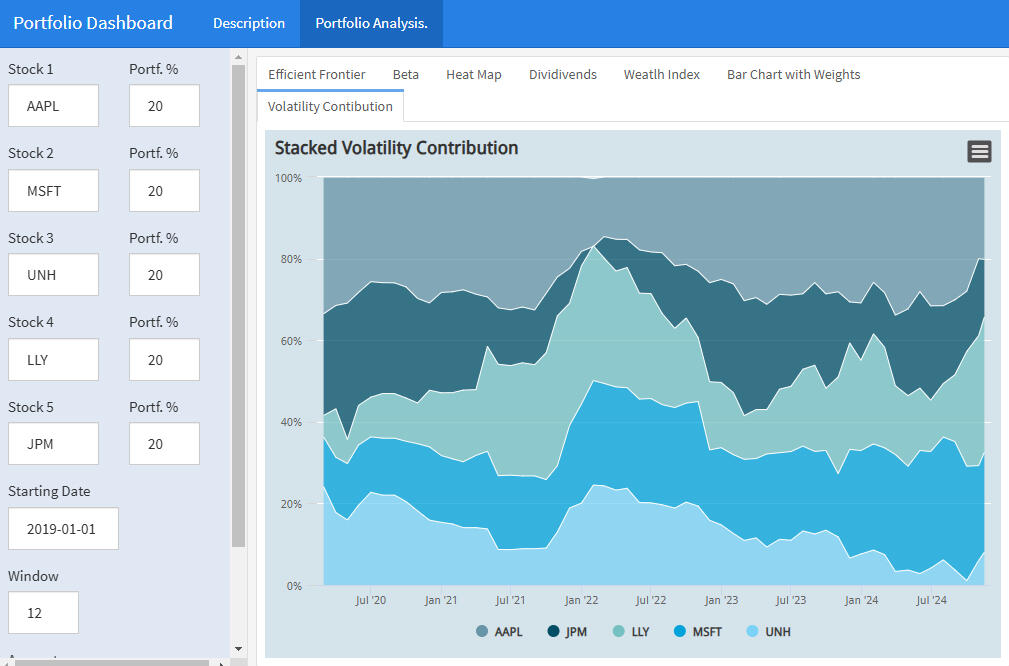

Here is propietary app where you can test part of our methodology for asset allocation. On the following app you can:

- Calculate asset evaluation of risk and return and produce and display the Eficient Frontier

- Calculate asset sensitivity to the market to produce and display each Asset's Beta

- Comparatively evaluate asset's performance in terms of its Fundamental Ratios

- Calculate asset's Dividend Yield and compare its perfomance with other assets

- Calculate past returns and produce and display a Wealth Index for certain invested ammount for certain date

- Considering user's selected allocation and display asset's risk contribution and comparison with its wight in the portfolio

- Considering user's selected allocation, display time-weighted asset's volatility contribution to the portfolio

Location ?

Recently there has been a considerable business and policy concerns regarding high vacancy rates of office and commercial spaces in urban areas. This has been a natural consequence of significant changes in consumer habits driven mainly by connectivity and technological advancements, shifts in work patterns, and the ongoing effects of the COVID-19 pandemic.Is well known that due to connectivity and technological advancements, consumer habits have been greatly affected by the rise of remote work, flexible work arrangements and the gradual success of online shopping. Many companies have adopted hybrid work models, allowing employees to work from home part of the time. As a result, there has been a decrease in demand for traditional office spaces in city centers. The progressive adoption of online shopping (e-commerce) reduced the need for street commercial sq ft and increasing vacancy rates. By mid-2010’s it was already observed that several shopping malls started to experience critically low occupations and some of them were repurposed, transformed, or demolished.Online remote work also contributed more recently and fiercely to decreasing traffic (and decreasing sales) in commercial retail spaces near offices and consequently higher availability and price degradation of commercial retail spaces.Business and Policy concerns have been addressed from several perspectives; however, a formal approach, from and economist perspective, turns out to be relevant to identify and address potential solutions.

Structural Changes

The effects of the changes of consumer habits drive important structural changes for and within the Real Estate industry. Connectivity and technological advancements have enhanced labor productivity regardless of location and synchronization of activities. Nowadays, an increasing share of the economy has turned to be digital (up to 25% in 2021 and growing at 10% annual rate for the US according to the Bureau of Economic Analysis). Digital economy does not require to be produced at the same location and can be asynchronous. It opened a wide range of opportunities for workers to contribute, profit, and improve productivity, in different locations and time zones. It broke several restrictions for employees, providing more convenient labor conditions and improving their living standards, but also harming several Real Estate Businesses’ structural conditions.New habits reduced what economist call “Barriers to Entry” for the Capital-Intensive Real Estate Industry. In the old days, without connectivity and technological advancement such as distributed and cloud computing, Business Owners were forced to claim concurrent presence of workers at a central office location. Nowadays, sq ft of worker’s residence in well-connected but cheaper sub-urban areas, currently compete with sq feet in urban, fancy, state-of the-art, and expensive areas. All what is required is connectivity, what substantially reduced all other locational and functional barriers to entry for the Office Space Real Estate businesses. New flexible, and adaptative business models have started to emerge, mainly in sub-urban areas that literally replace the functionality of the traditional office space model, now obsolete.The fist noticeable impact for the industry is towards the optimal scale of the business unit. In the old days without connectivity and technological advancement such as distributed and cloud computing, Economics of Scale seemed unstoppable. Taller and bigger buildings in locations near transport hubs and other similar buildings, seemed to outperform any other offering. The higher the density of usage per sq ft of land, the more profitable seemed in terms of value and revenue potential. This concept seems to start facing its limits now that occupation faces important challenges. Value is a function of potential or actual revenue, and revenue is a function of occupation and traffic. Now that occupation and traffic have been declining and maintenance costs and taxes (carry cost) remain, value started to be questioned. So nowadays, in the new reality, the optimal scale of the business unit for Office Space seems to be limited regardless of surrounding infrastructure availability.Along with the fall of Barriers to Entry, including the optimal unit scale as one of them, new players may participate in the market with new, innovative, and relevant offerings. Markets in which many firms can enter and exit rapidly are called Contestable Markets. In this sense, Real Estate Office Space Industry has become increasingly contestable and increasingly competitive. Due to the above, sq ft owners will (and have already started to) reduce Price Rigidities. Either by reducing prices, relaxing terms and conditions for clients, or forced to invest in new amenities of facilities to retain or attract clients, sq ft owners of office spaces will be required to adjust prices. Pricing will be increasingly more dependent on competition’s offering, necessarily reducing bargaining power of sq ft owners.With increasing availability of sq ft in the surroundings, new and more sophisticated offering near to labor’s housing, a different pricing structure, and unstable market conditions; price elasticities (occupation sensitivity to price changes) will induce increasing uncertainty for both owner and leasers, affecting contractual length and other contractual terms fundamental to sustain Price Mark-ups and owner’s margins. Uncertainty also means increasing transaction costs what also represent an aditional burden for owner's margins.An increasingly contestable market conduces to Non-Cooperative Behaviors within the industry. With Predatory Pricing as the primary and more natural behavior, sq ft owners will face fierce competition that may lead to other predatory strategies. It is relevant also to understand that Real Estate Industry is highly leveraged under the assumption that Real Estate valuation is always on the rise. We have discussed earlier that this assumption may not be sustainable this time. Market participants facing debt, have high incentives for predatory strategies to comply with their debt repayment requirements. The higher the leverage in the industry, the higher the fierce price competition in the industry.All along with the above comes the effect of the de-consolidation of the industry. Effects on the Optimal Business Unit Scale, drives to a structural changes within the firms holding this kind of assets. Contestable market erodes Market Power of incumbent firms with out scaled and obsolete business models, holding obsolete assets and facing expensive carry costs.

Opportunities and means for resilence

The effects of the changes of consumer habits force the sq ft owners of Office Space to face challenges from an innovative and creative perspective; however, a formal approach, from and economist perspective, turns out to be relevant to identify and address potential solutions.In conjunction with the aforementioned challenges, new context provides opportunities to take advantage of (or enhance) Economics of Scope from the capital already deployed. Economics of scope implies that is efficient to produce two or more products utilizing the same production facility.For a Real Estate facility, Economics of Scope means use the facility for two (or more) different purposes, let’s say offices and housing, a mixed-use including office, commercial and residential components. Although is not that simple, and requires additional capital to be deployed to adapt the facilities, it seems to be the logical alternative for survival. It is not the fist time entire zones of cities are repurposed to adapt to new realities. This time the repurposing will tend to be oriented to satisfy the emergent needs of an emergent type of workers. Recent surveys show that social integration seems to be an important driver. It is still speculative but some analysts believe those facilities, if properly re-adapted, may be a catalyst to create new integral vibrant vertical communities, that may achieve integral and profitable full potential usage of massive office buildings.Another contingent strategy is product differentiation. To regain Market Power at least for a particular niche, sq ft owners will be required to differentiate their product from their competitors. Differentiation refers to the degree to which products or services offered by different firms are perceived as distinct in the eyes of consumers. Greater product differentiation leads to reduced substitutability and increased market power. To achieve this goal, sq ft owners will have to clearly identify what it’s been demanded in their market, by, for instance, enhancing technological infrastructure, upgrading digital amenities, such as high-speed internet and smart home features, providing or enhance recreational areas and features for improved work-life balance; all that can attract remote workers to urban housing. Success is not guaranteed in uncertain market conditions. However, doing nothing is almost a certain guarantee for failure.If not an integral solution, Non-Linear Pricing may provide a path to search for pricing mark ups. Non-Linear pricing refers to price adaptability according to either client specificities, market conditions, demanded features, etc. An example of this can be auctioning sq ft according to certain conveniences or by charging for unique experiences This strategy demands relaxation of current regulation of the market what requires authorities understanding of current context.Another case of partial solution refers to be Information Asymmetries. In unstable and uncertain market condition information asymmetries provide opportunities for Non-Linear pricing. Rebranding and Marketing emphasizing the advantages of urban living while catering to remote work preferences may attract the right costumers. Under market deconsolidation and transformation, a de-standardization of market offering as well as pricing, will provide opportunities for new mark-up and new price rigidities under certain conditions.In our firm we are ready to provide a professional service attending punctually the efects of Ecnomics of Scale, Ecomics of Scope, Linear and Non-Linear Pricing, Differentaion and Pricing Elasticities for your company to face what is about to happen in the Real Estate Industry.

Current Gainers and Losers

Office and Commercial: The shift in consumer habits towards remote work and flexible office arrangements has significantly impacted the commercial and Office Space real estate industry. Traditional long-term office leases are becoming less attractive to businesses as they seek to optimize costs and adapt to changing work patterns. Co-working spaces like WeWork and Regus have seen a surge in demand as businesses opt for flexible office solutions that allow them to scale up or down according to their needs without committing to long-term leases. According to a survey conducted by JLL in 2021, flexible office spaces saw a 24% increase in demand year-on-year. Current new trend: Flexible officeResidential: The changes in office space consumption have also influenced residential real estate trends. As more professionals adopt remote work, there has been a shift in housing preferences towards suburban and rural areas, away from city centers. According to the National Association of Realtors, in 2021, the median sales price of existing homes in suburban areas increased by 11.2%, outpacing the growth in urban areas by 5.7%. In cities like New York and San Francisco, where high-density urban living was once preferred, there has been an exodus to the suburbs due to increased remote work opportunities. This shift has driven up demand and prices for single-family homes in suburban locations. Current Trend: SuburbanizationIndustrial: The changes in office space consumption have had ripple effects on the industrial real estate sector. With the rise of e-commerce and the need for efficient last-mile delivery solutions, there has been a surge in demand for warehouse and distribution center spaces. According to a report by CBRE, the demand for last-mile distribution centers grew by 50% in the past two years, and the vacancy rates for these properties have dropped significantly, driving up rents by an average of 7.5%. Amazon's expansion and its emphasis on one-day and same-day delivery have led to a massive demand for strategically located distribution centers near urban centers. This change in consumer habits has forced industrial real estate developers to focus on constructing properties suitable for last-mile delivery logistics. Current Trend: Last Mile DeliveryHospitality: The hospitality sector has been significantly impacted by the changes in consumer habits of office spaces. The decrease in business travel and corporate events has led to shifts in the types of properties and services that are in demand. With fewer corporate travelers, hotels and resorts have been adapting their offerings to attract "bleisure" travelers - those who combine business trips with leisure activities. This adaptation includes providing enhanced amenities and experiences beyond traditional business services. According to a study conducted by Expedia in 2021, 60% of business travelers reported taking bleisure trips, and 87% of them extended their stay for leisure purposes. A well-known hotel in a major business hub noticed a decline in weekday occupancy rates but a surge in weekend stays. To cater to the new consumer habits, they rebranded their business center as a "collaboration lounge" with co-working spaces, and they offered weekend packages with curated local experiences to attract bleisure travelers. Current Trend: Bleisure Travel.

Our Data Sciece Practice

Your Company is generating an increasing volume and variety of data. You should be aware that your Businesses are facing challenges in managing the vast amounts of data collected from your own systems. Information and Value that you have been wasting.Morevover, the increased use of mobile, social media, and smart devices have fueled the growth of extremely useful ammount of data to enhance your competitvity and decision making.Data science is an interdisciplinary field that uses scientific methods, processes, algorithms, and systems to extract value from data. Data scientists combine a range of skills, including statistics, computer science, and business knowledge, to analyze data collected from the web, smartphones, customers, sensors, and other sources.Value Edge is now prepared to help you in the challenges of extracting large volumes of structured, unstructured, and semistructured data, from your own company or from market-originated sources; as well as clean, analyze and provide insights in real-time for your promt and optimal desicion making.Our Data science platform is the combination of statistical, mathematical, and programming techniques that use Machin Learning (ML) algorithms and advanced analytics to uncover insights from data and automate data processing activities, such as data discovery, data cleansing, data preparation, data analysis, and data visualization.Value Edge helps organizations in making data-driven decisions to enhance operational efficiency and improve customer experience among other purposes.

If your company does not profit from your own data, your competition certainly does